Does home financing make your head hurt?

You feel totally out of your depth with financial stuff

The house buying process feels scary

You’ve had loans before and worry about taking on more debt

Paperwork gives you a headache

Here's how we can help

Purchase

You’re looking for the best way to buy a home. We’ll help you determine the optimal mortgage financing plan for buying a home, then track it with monthly updates and annual reviews.

Refinance

Real Estate Review

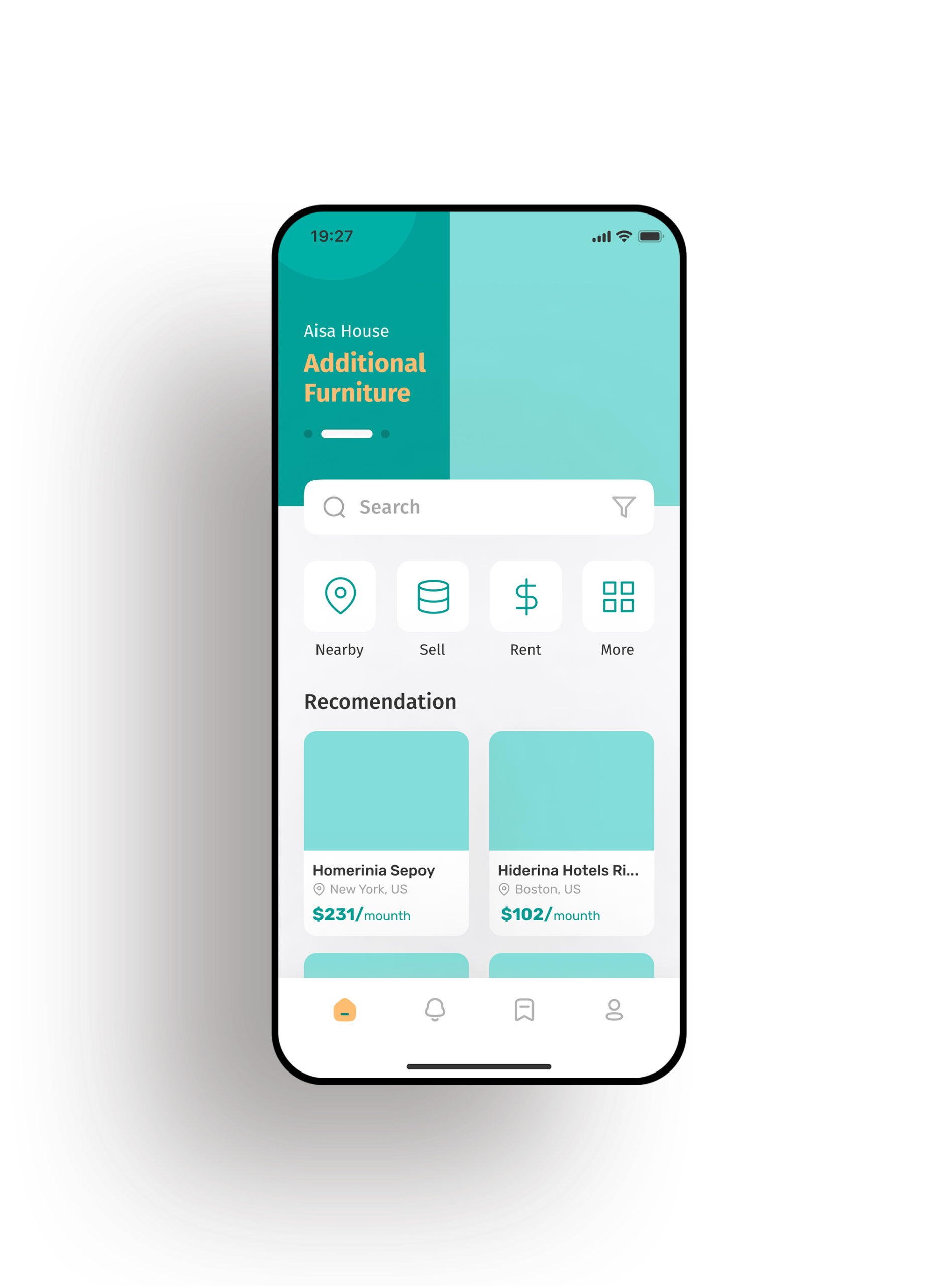

We've Got an App to Make it Easier

Know exactly what your payment will be for any property

Get started on the home buying process with ease

Know when you’re eligible

Make the right mortgage decision with confidence

See how we helped these clients maximize their investment and become total mortgage masters.

First Time Homeowner

From shaky credit to first time homeowner

First-time home buyer Jeremy wasn’t even sure he could afford to buy.

He had a lot of debt and a shaky credit profile. He wasn’t just overwhelmed by the mortgage process, he was uncertain about his financial future.

The house buying process can be exhausting, scary, and make you feel totally out of your depth. But if you’re already unsure about your eligibility? It can feel even more overwhelming. When Jeremy came to us, everything seemed lined up for his first home purchase. He had some cash, he was making good money, and he loved the property already. But he had a troubled credit history from years past.

After a comprehensive financial review, we gave Jeremy a credit improvement gameplan. Our goal: to get his credit above the minimum threshold and increase his eligibility. He implemented our plan, and within a few months boosted his credit profile to above the threshold for approval. Win! Except, his was a rare case where simply the nature of his credit profile was enough to exclude him from conventional loan approval. Just because his score was up, the FNMA risk analysis still wasn’t accepting it.

So, we reviewed his finances again and came up with a new plan. This time, his loan was approved and he was able to buy his first home.

If you’re not sure about your eligibility, you’re not alone. That’s why we’ve got a whole process to help clients understand their current financial picture and plot a clear course for their future.

Refinance & Remodel

She Refinanced & Remodeled

Amy already had a house at a really low interest rate. (We helped her buy it!) So when she came to us looking to reassess her loan situation, we told her she was ALREADY way below the threshold. But then she told us she’d done a ton of remodeling and had racked up loads of credit card debt.

We got together and took another look at her current financial picture. It turned out she had a lot of equity. And a lot of debt. After a careful analysis, we realized that she did have better options.

We secured her a new loan at a slightly higher rate. This enabled her to pay off ALL her debt and gave her $20,000 in cash immediately. She used the cash injection to finish her entire remodeling project in one fell swoop.

Plus, we reduced her monthly obligations by $650, immediately. As it turns out, a slightly higher rate was actually better for her in the short-term and long-term.

We’re not just here to help our clients get a mortgage. We’re here to help them get clear on how to make smart money decisions. Our 7-step process makes it easier to become a total mortgage master. We call it the Borrow Smart™process. You can think of it kind of like corporate restructuring for your personal finances.

Finance Your Dream Home

They Financed Their Dream Home

Tony and his wife Elane already owned their house, and a few rental properties. But they were looking to relocate closer to their kids and grandkids. So, when they found their dream home, perfectly located close to family, it was a no-brainer. Except, they soon discovered it wasn’t that easy.

Even with all their equity, the amount they needed to borrow exceeded it. They’d need to sell their current house to put a down payment on their dream home. We sat down together and reviewed their entire financial picture. And, yes, we crunched a lot of numbers.

After developing a new plan of action, we were able to secure them a bridge loan that enabled them to show up and win a competitive offer on their dream home. We also worked together post-purchase to make sure their payment plan and fee structure still benefited their future financial goals.

Whether you’re a first time home buyer, or a seasoned homeowner looking to buy your forever home, our Borrow Smart Process™ takes the stress out of buying and refinancing. We’re here to help you choose the right loan strategy to get you more return on your investment over time.

Here's how we'll work together

Setup a Strategy Call

We’ll discuss your unique goals and give you clarity around the best next steps.

Review Your Options

We conduct a Total Cost Analysis to determine your optimal mortgage strategy.

Maximize Your Wealth

Relax knowing the right team is executing the right plan on your behalf.